Chairman Zhang Bo presents Hongqiao Group’s first semester

of 2021 unaudited consolidated interim results.

In the first half of 2021 the global economic recovery

momentum became stronger and China’s domestic economy continued to maintain a

stable recovery. According

to the statistics of the National Bureau of Statistics of China, the gross

domestic product for the first half of 2021 amounted to RMB53,216.7 billion,

representing a year-on-year increase of 12.7%.

Industry Overview

From the industry perspective, in the first half of 2021,

with the sustained global economic recovery momentum, the aluminum consumption

recovered and grew, with the supply of primary aluminum in the PRC reaching its

maximum production capacity. It is

expected that real estate, automobile and infrastructure industries may

continue their steady growth momentum in light of the sustained positive

macroeconomic development in the PRC in the second half of the year, which will

boost aluminum consumption, driving aluminum prices to surge significantly and

favoring the continued development of the aluminum industry in the medium- to

long-term.

According to statistics from Antaike, the global output of

primary aluminum in the first half of 2021 was approximately 33.777 million

tonnes, representing a year-on-year increase of approximately 5.1%; the global

consumption of primary aluminum in the first half of 2021 wasapproximately

33.899 million tons, representing a year-on-year increase of approximately

9.9%. For the domestic market, the output of primary aluminum in the PRC in the

first half of 2021 was approximately 19.577 million tones, representing a

year-on-year increase of approximately 7.9% and accounting for approximately

58.0% of the global output of primary aluminum; the consumption of primary

aluminum in the PRC in the first half of 2021 was approximately 19.899 million

tonnes, representing a year-on-year increase of approximately 8.5% and accounting for approximately 58.7% of the global

consumption of primary aluminum.

Business Review

During the Period, the Group’s output of aluminum alloy

products and aluminum fabrication products was approximately 2.801 million tons

and 0.369 million tons, respectively, representing a slight increase as

compared with the corresponding period last year. The comparative figures of

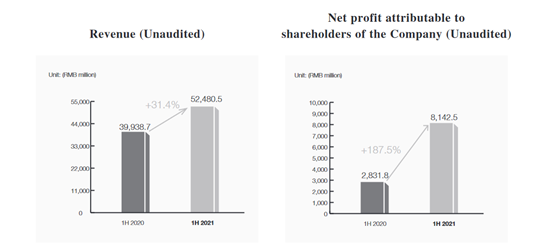

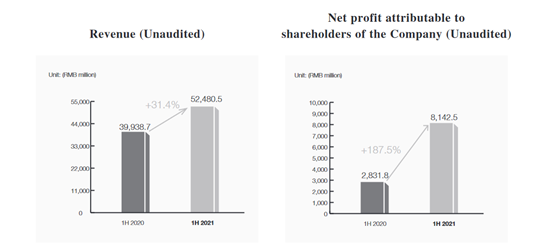

the Group’s unaudited revenue and net profit attributable to shareholders of the Company for the six months ended 30 June 2021 and for the corresponding

period of 2020 are as follows:

Sustainability

During the Period under Review, the Group continued to be

committed to high-quality and sustainable development under the guidance of new

development concepts by vigorously optimizing its energy structure,

implementing industrial transformation and upgrading and maintaining positive

and effective performance in green development.

In particular, the contracted production capacity of the

Yunnan green aluminum innovation industrial park which, after the relocation is

completed, will enable the Group to increase the proportion of its aluminum

production capacity from clean energy to approximately one-third.

This project has become a role model for green development

of the aluminum industry in the PRC. At the same time, the Group’s

lightweight material project based on the strategy of “Three New (new

infrastructure, new material and new applications) and One High (high

value-added)” also continued its progress.

Energy-efficiency/Energy-saving

In the first half of 2021, adhering

to its business models of “Integration of Upstream and Downstream Businesses”, “Global Integration”, and “Green Smart

Integration”, the Group proactively seized the favorable opportunities to

expedite the transformation and upgrading for its development through various initiatives such as actively

adjusting its energy structure, optimizing its industrial layout and increasing

investment in scientific research and innovation, so that the quality of

development could be improved further.

During the Period, the Group’s project of standardized

energy-saving production of electrolytic aluminum

successfully passed the inspection for acceptance of the Standardization

Administration of the PRC. The Group’s Aluminum & Power’s model of

standardized electrolytic aluminum production will play a positive leading role

in further enhancing energy efficiency in the industry.

In pursuing debt structure optimization, the Group continued

to deleverage and completed a number of financing projects through diversified

channels at the same time, further consolidating the sustainable development of the Group.

Looking forward to the second half of the year, the Group

believes that with the solid development foundation and steadily increasing

consumption demand for aluminum, China’s aluminum industry will maintain its

positive operating momentum. However, as the global pandemic has not completely vanished, there will still be both

challenges and opportunities for the aluminum industry ahead. As always, being

a leading enterprise in the industry, the Group will continue to actively

respond to the “Dual Carbon” goals of the PRC by proactively fulfilling the

responsibility of reducing carbon emissions and firmly implementing effective

initiatives for achieving the “Dual Carbon” goals. Through the implementation

of relevant strategic planning projects, streamlining its systems and taking

more effective measures for reducing carbon emissions, the Group will further

improve its basic corporate management standard while effectively fulfilling

its social responsibilities, and strive to make positive contributions to

promoting the low-carbon transformation of the industry and achieving the “Dual

Carbon” goals of the PRC to counter the effects of global climate change.

Internationalization

In addition, the Sino-German Hongqiao Scholz Circular

Economy Science & Technology Project by the Group and Germany’s Scholz

China GmbH officially kicked off in May 2021. The project is a circular economy

technology project focusing on the recycling of metal and resource reuse and is constructed for both domestic

and international circular economy industrial parks with the highest standards.

It is also one of the specific initiatives that the Group has taken for

proactively implementing the low-carbon transformation and facilitating the PRC

to achieve the goals of “reaching the peak of carbon emissions and achieving

carbon neutrality” (the “Dual Carbon” goals) to respond to the global climate change.

As for overseas business, the Group’s bauxite mining in

Guinea continued and the construction of the phase 2 alumina project in

Indonesia was progressing smoothly.

Bonds & Investment

During the Period under Review, the Company raised funds of HK$2,324,000,000 by way of top-up

placing and successfully issued US$500,000,000 6.25% senior unsecured notes due

2024 and US$300,000,000 5.25% convertible bonds due 2026, and Shandong New Material Co., Ltd

(“Shandong Hongqiao”), a subsidiary of the Company, also successfully completed

the issuance of corporate bonds with a principal amount of RMB1,000,000,000

during the Period, all of which were heavily oversubscribed by domestic and

foreign investors, fully reflecting the fact that the Group is highly recognized

by the capital market.

For the six months ended 30 June 2021, net profit

attributable to shareholders of the Company amounted to approximately

RMB8,142,519,000, representing an increase of approximately 187.5% from

approximately RMB2,831,849,000 for the corresponding period last year.

During the Period, basic earnings per share of

the Company were approximately RMB0.903 (the corresponding period of 2020:

approximately RMB0.330).

On behalf of the Board, Hongqiao’s Chaiman, Mr. Zhang Bo

would like to extend his sincere gratitude to the Group’s management team and

employees for their efforts and dedication in the first half of 2021, and to

our shareholders, investors and business partners for their support and trust.

Mr. Zhang Bo

Chairman of the Board

20 August 2021

Full report

available here.